Automated E-commerce Bookkeeping

Boost Your Online Store’s Profit & Save on Fees

Our smart system seamlessly imports sales data from platforms like Shopify, Amazon, and eBay – categorizing transactions, tracking online expenses, and identifying tax savings. Save up to 80% compared to traditional bookkeeping services designed for e-commerce.

Start Free NowNo CC Required

Your $500/Month Bookkeeper for E-commerce Just Met Their Match

Traditional bookkeeping for online retailers can cost up to $6,000 per year – and that's before costly CPA fees. Our smart platform integrates your online sales channels, automatically categorizes digital transactions, and delivers real-time insights – all for a fraction of the cost.

How It Works

Your modern bookkeeping solution for online retailers in three simple steps

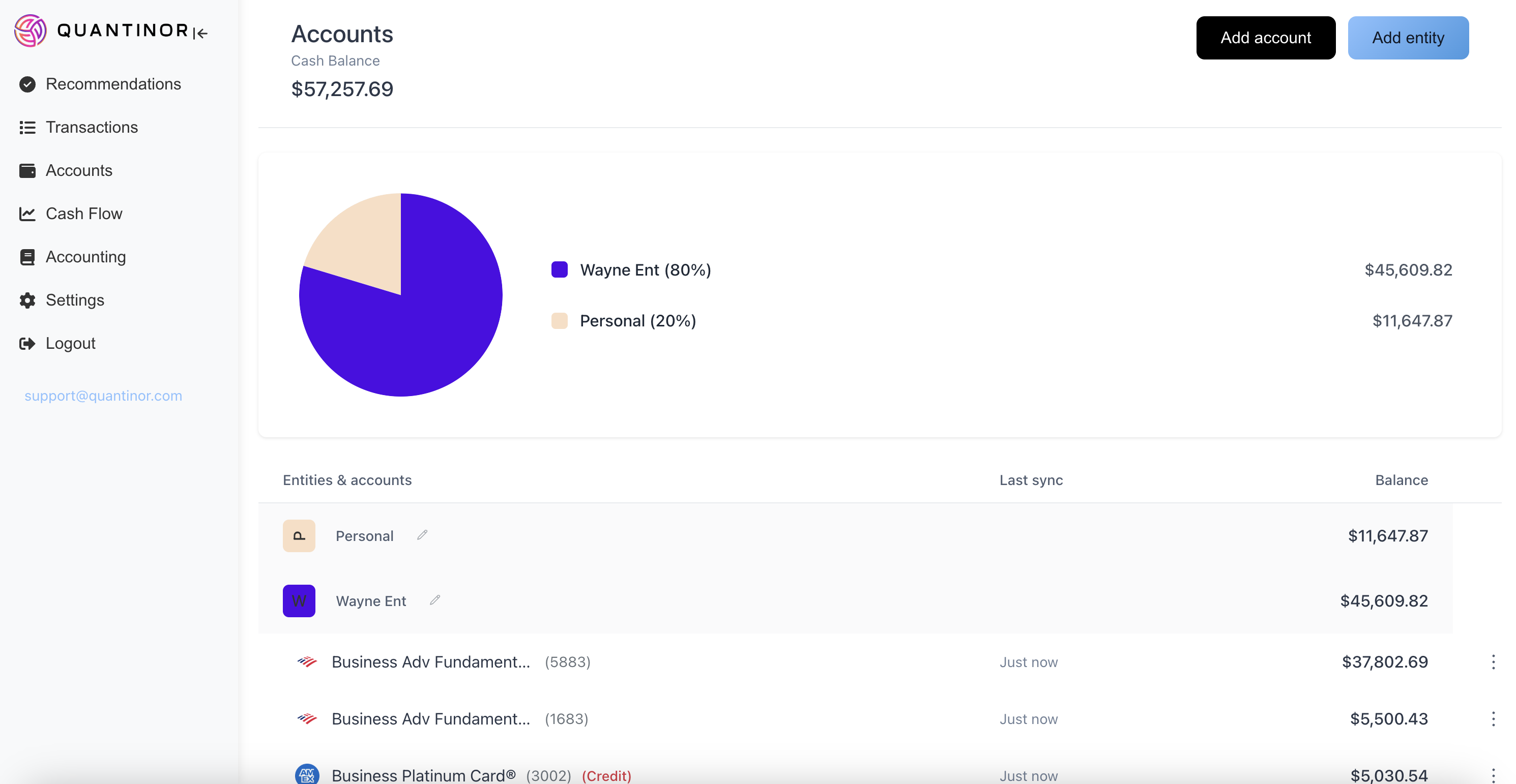

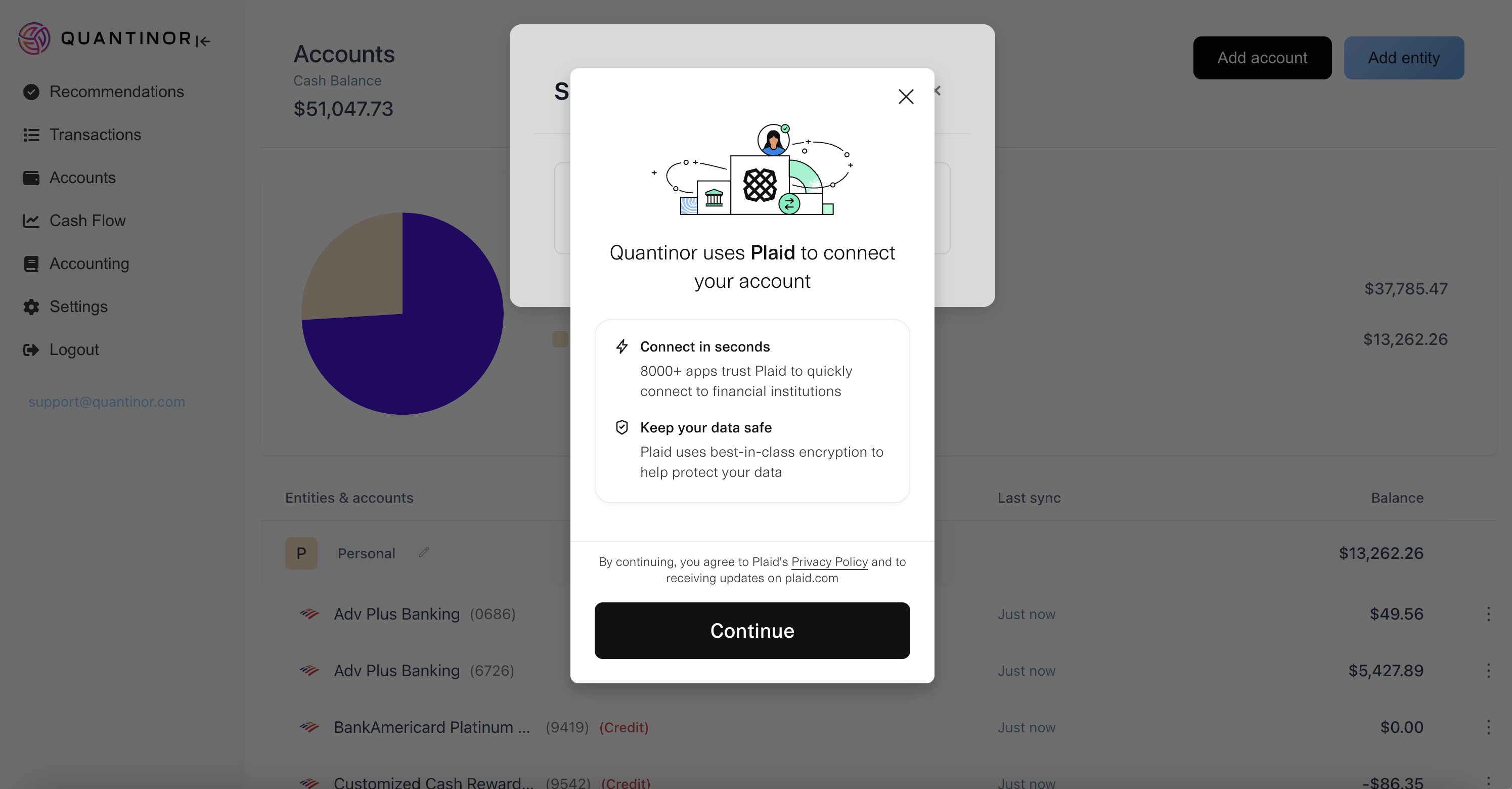

Connect Your Financial & Sales Accounts

Securely link your bank accounts and integrate your online sales channels like Shopify, Amazon, or CSV uploads in just minutes. No more manual data entry, spreadsheets, or missed transactions. Create entities and assign accounts to keep your e-commerce finances organized automatically.

- Bank-level security

- 2-minute setup

- Multiple import options

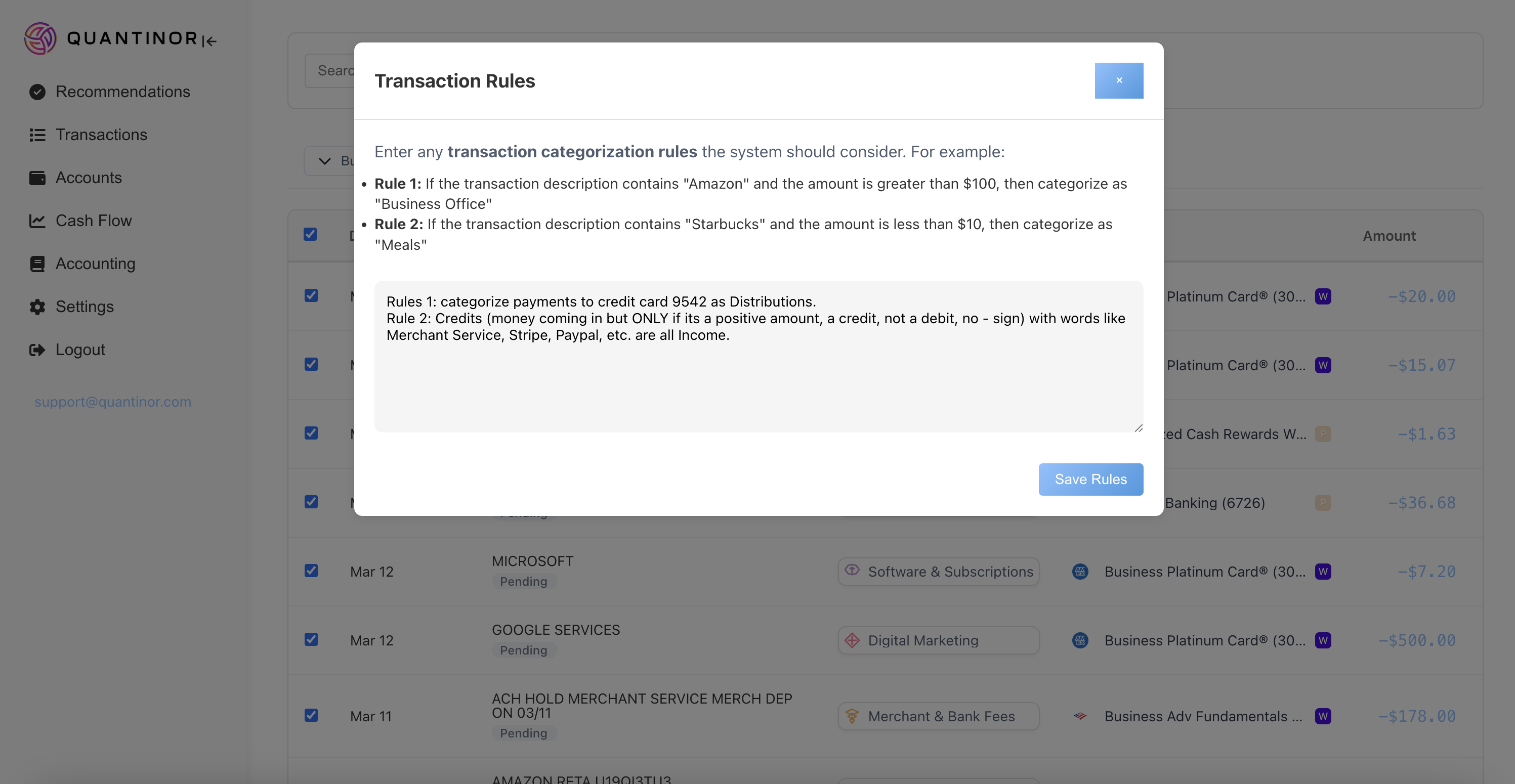

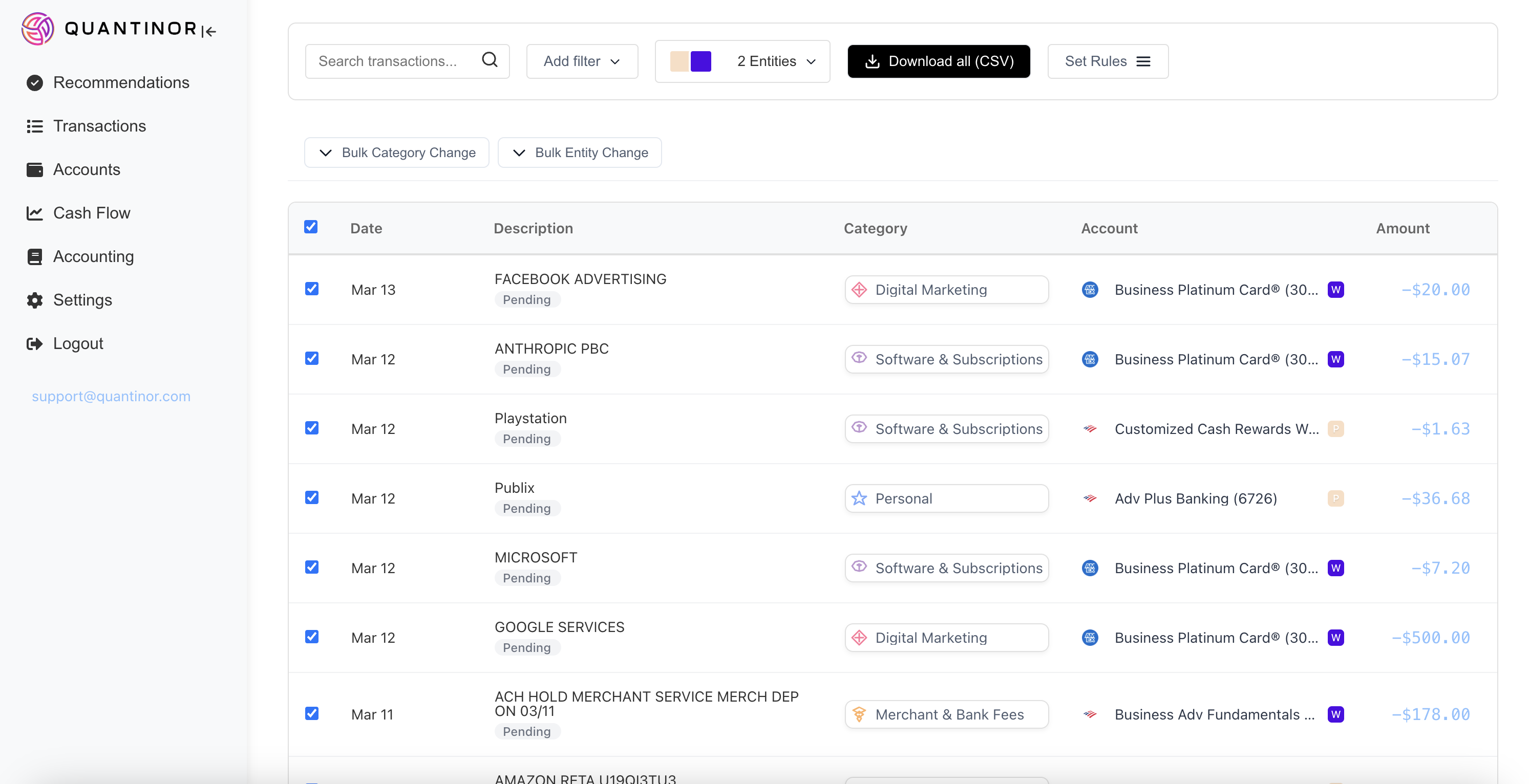

Smart Automatic Categorization

Watch as Quantinor's smart system instantly processes and categorizes every transaction from your online store, ad spend, and shipping fees – identifying tax deductions and business expenses you might have missed. Create custom rules once and let our system handle the rest forever.

- Automatic categorization

- Tax write-off detection

- Custom rules engine

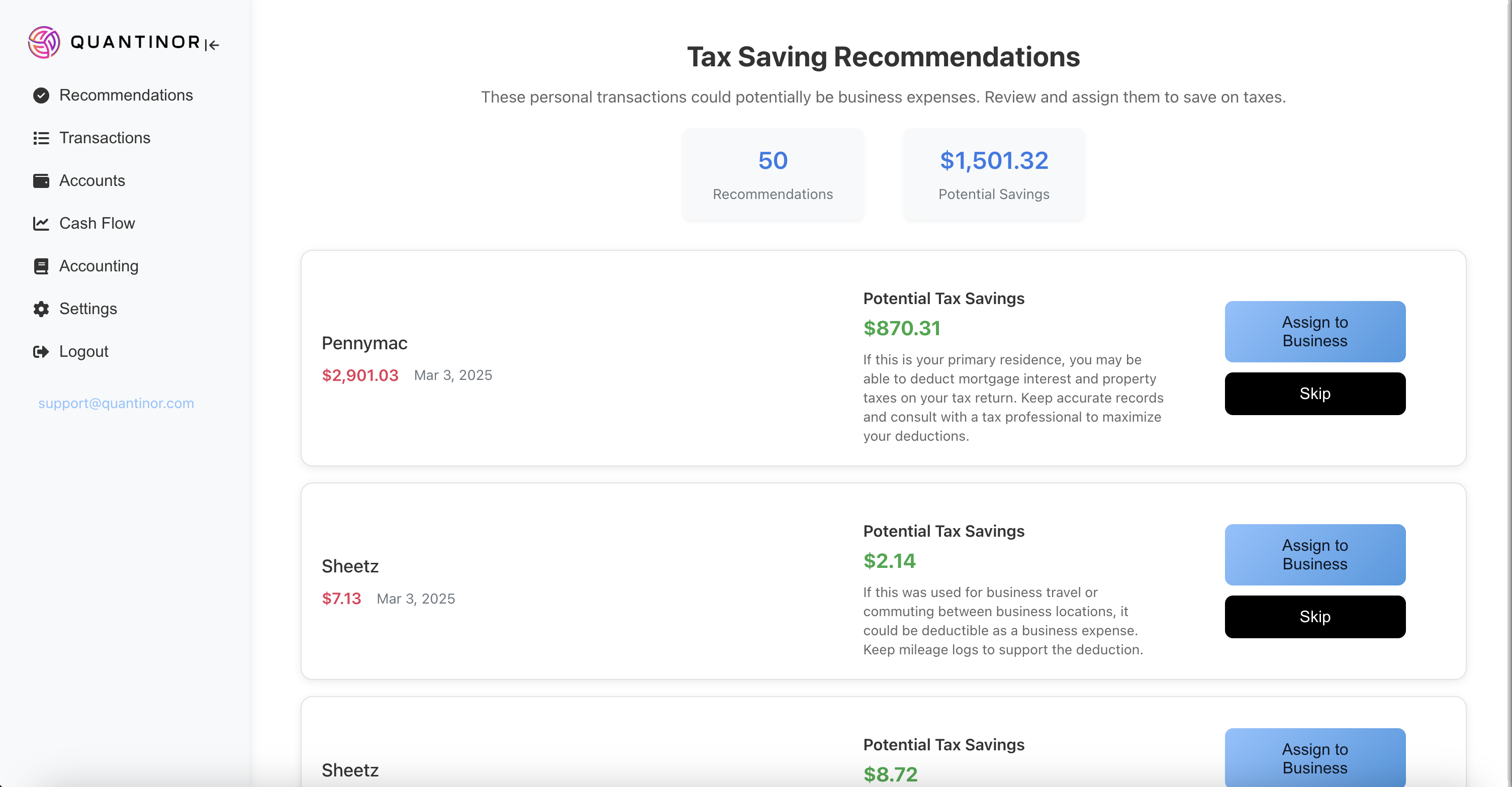

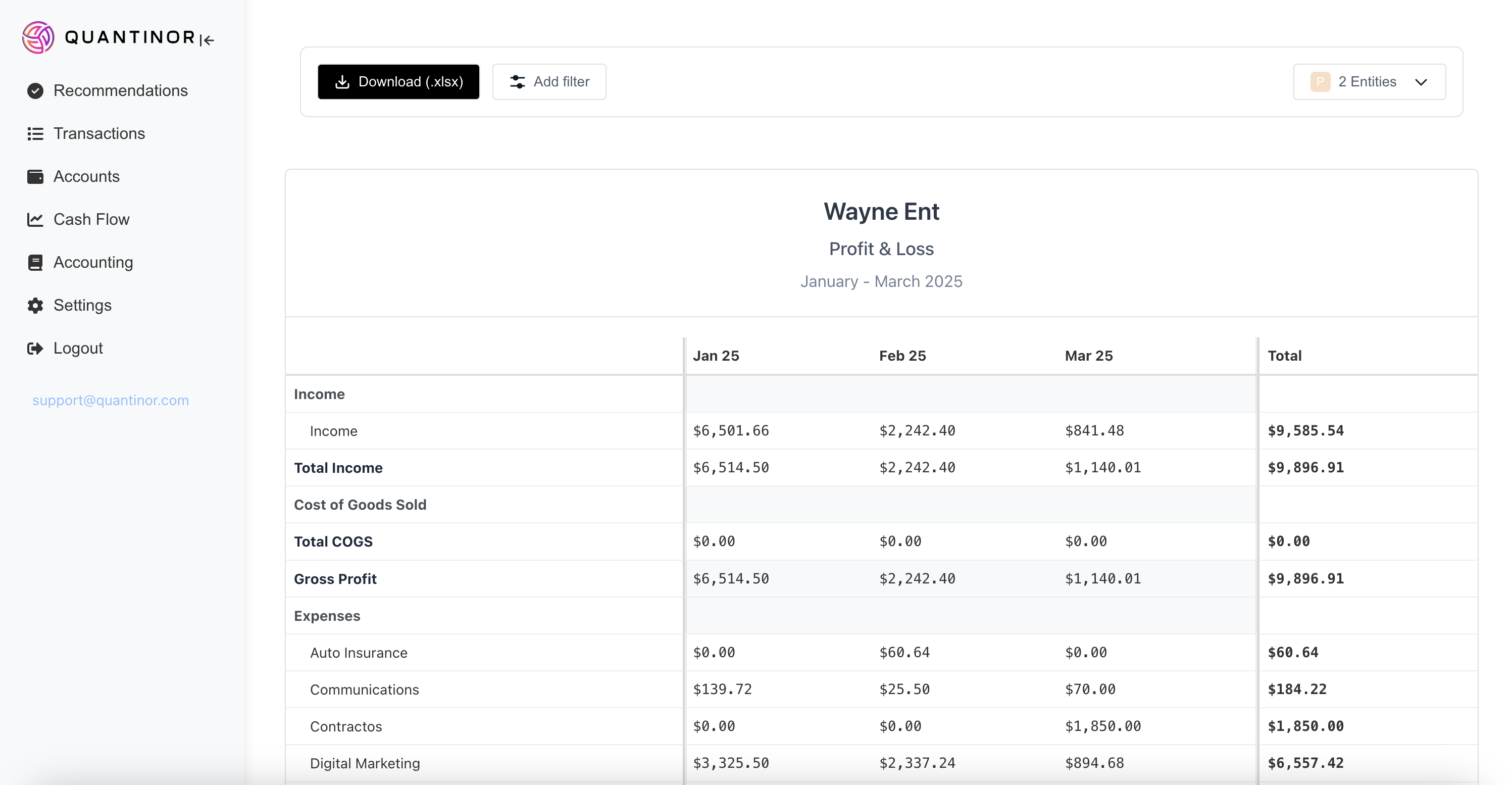

Financial Clarity & Tax Savings

Say goodbye to tax-season panic. Access professional, e-commerce-tailored financial reports anytime, download ready-to-file statements, and share with your CPA in one click. Finally, understand your online store's cash flow and make confident business decisions.

- One-click CPA sharing

- Real-time financial dashboards

- Tax-ready documentation

Smart Transaction Categorization

Watch as Quantinor automatically categorizes transactions from your online sales channels in real-time. Our smart system learns from your e-commerce patterns, ensuring accurate books with minimal effort.

- Real-time Processing

- High-level Accuracy

- Custom Categories

Maximize Tax Deductions

Never miss a deduction again. Our system automatically identifies potential tax write-offs – from online advertising and platform fees to shipping costs – and keeps detailed records for your e-commerce business.

- Automatic Detection

- Complete Documentation

- Tax Optimization

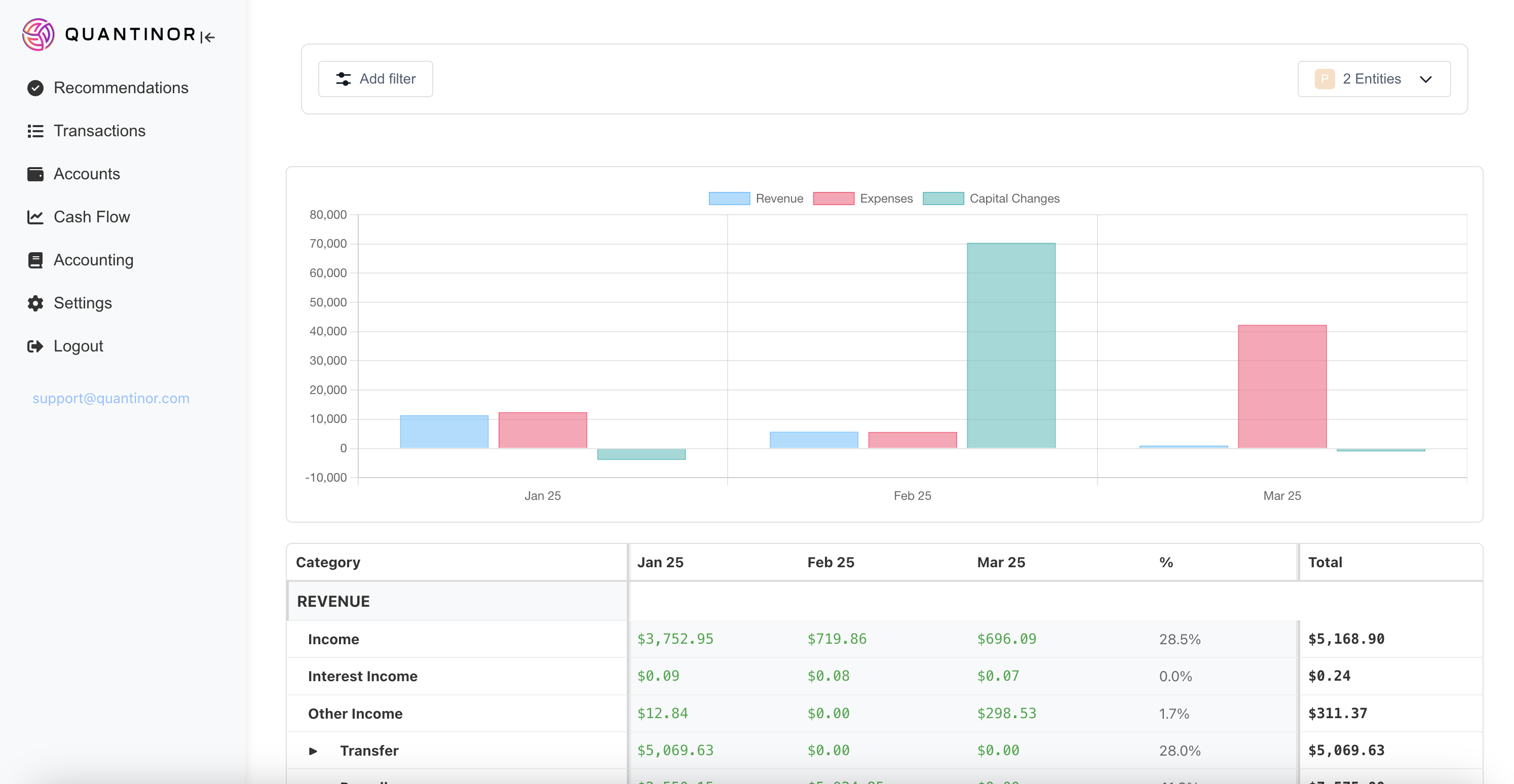

Real-time Financial Insights

Get instant visibility into your online store's performance with dynamic dashboards and reports. Track revenue, ad spend, shipping fees, and understand your cash flow at a glance.

- Live Dashboard

- Expense Analytics

- Revenue Tracking

Multi-Entity Management

Manage multiple online storefronts or brands from one dashboard. Track intercompany transfers, consolidated reporting, and maintain separate books for each e-commerce channel with ease.

- Unified Dashboard

- Entity Separation

- Consolidated Views

CPA-Ready Financials

Generate professional financial statements instantly. Share e-commerce-ready reports with your accountant or tax advisor with one click, making tax season stress-free.

- Professional Reports

- Easy Sharing

- Tax-Ready Data

Bank-Level Security

Rest easy knowing your financial and sales data is protected with enterprise-grade security. Our system uses advanced encryption and follows strict compliance standards.

- 256-bit Encryption

- Secure Integration

- Data Protection